We are a nation who prides ourselves on being able to promote a middle class, which affords a decent lifestyle for families without relying on social services. Yet as the cost of healthcare and housing increase, this middle class of boomers may find themselves unable to afford housing as they age. They are both too wealthy to benefit from Medicaid and they might not be able to pay for the high costs of independent or assisted living communities. According to the 2019 – 2023 Hawaii State Plan on Aging, by 2020 1 in 4 residents of Hawaii will be 60 years of age and older. There will be a 31.7% increase in older adults 85 years of age and older over the next 10 years between 2020 and 2030. This means that there will be a large number of Hawaii residents who need to create a housing plan that works for their financial situation.

The following are strategies that you can follow when preparing a senior housing plan. Your situation may vary, but these suggestions will give you ideas on what you need to consider for your personal situation.

1. Assess your cash flow. One of the easiest ways to run out of money is to not know where it is going. Sit down and write out all of your current expenses both fixed and discretionary. Be sure to itemize all of your expenses and make a separate line item for housing. You may also want to meet with your financial planner to understand what retirement income you’ll have available to pay for your current level of expenses. Being able to live comfortably in your senior years is more a matter of how much cash flow you have, than how much assets you are able to keep. Sometimes, you need to utilize your assets in order to maintain a consistent cash flow.

2. Decrease your housing expense. Though we might feel healthy and wonderful at the moment, this could change in an instant with one bad injury or an unexpected illness. With the median cost of Hawaii housing at $673,125 for a single family home and $445,050 for a condominium, we hope that your property is owned free and clear without any mortgage debt remaining. If you do have a loan balance left, then you may want to determine how to decrease your monthly housing payment by paying off your loan or considering a reverse mortgage. This way, you can plan for unexpected costs in medical or health related expenses.

3. Downsize to simplify life. It may not make sense to keep a 3 or 4-bedroom house if there are only two people in the home. Unless you anticipate kids or family members coming to live with you, consider downsizing into a smaller single level home or a condominium. This will decrease your housing expense while making it easy to enjoy other aspects of life without worrying about maintaining your property.

4. Create a cash flow opportunity. The current ADU (Accessory Dwelling Unit) laws still exist allowing you to create a separate legal rental unit on your property under certain requirements by the City and County of Honolulu. If you do decide to rent out a portion of your property, you can generate some additional cash flow to pay for expenses in retirement. Not to mention, you can always decide to live in the smaller unit and rent out the main dwelling, and have enough funds to enjoy traveling the world.

5. Consider a multi-generational home. Some seniors look forward to having an active life where they can still work or serve in the community and be more independent. Others may want to take care of family and remain in the property that they currently own. The lifestyle you want to have will determine the kind of housing that you will enjoy. If you want to take care of family then you might be in the segment of the population who will consider creating a multi-generational living situation, where your children can benefit from a lower housing expense and you can benefit from family being with you through the years.

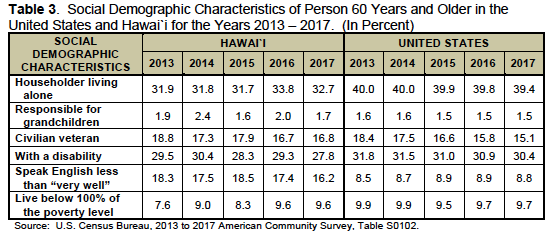

According to the Hawaii State Plan On Aging, “only 32.7% of its older adult population live alone whereas, 40% of older adults live alone in the U.S. In 2015 approximately 36,203 Hawai`i households (11.6%) are multigenerational, defined as households with more than two generations living under the same roof.” The following are social demographic characteristics of a person 60 years and older in the United States and Hawaii for the years 2013-2017.

6. Age in place. It may not be feasible for you to pay $5,000 a month to live in an independent living facility and you may not quality for Medicaid because you have too many assets. If you find yourself in the middle, and the cost of senior housing is a bit high, consider aging in place with assistance from in-home care professionals. In-home care professionals cost approximately $25 an hour but you may not need ‘round the clock assistance. You can even subscribe to a third party meal plan where you can have healthy meals delivered to you each day. Home modifications will also be required to decrease your risk of falls and to make it more comfortable to live. Aging in place will take more planning, but it could also be a lot more affordable for the time that you are able to live independently.