Credit scores help lenders decide whether or not to approve loan applications and determine what loan terms to offer. The scores are generated by algorithms using information from your credit reports, which summarize your borrowing history.

Credit Score Basics

Credit scores are designed to make decisions easier for lenders. Banks and credit unions want to know how much of a risk you might be to default on your loan, so they look at your borrowing history for clues. For example, they want to know if you have borrowed money before and successfully repaid loans or if you recently have stopped making payments on several loans.

When you get a loan, lenders report your activity to credit bureaus, and that information is compiled into credit reports. Reading through those reports is time-consuming, and it can be easy to miss important details. With credit scores, a computer program reads that same information and spits out a score lenders can use to evaluate how likely you are to repay.

Credit scores can be a valuable tool to borrowers. Lenders are less able to use subjective judgment when a score tells them most of what they need to know. Scores shouldn’t discriminate based on how you look or how you act.

Types of Scores

You have multiple credit scores. For every scoring model that’s been developed, you have at least one score. Most people refer to FICO credit scores, but you have a different FICO score for each of the three major credit bureaus: Equifax, Experian, and TransUnion. When talking about your credit, it’s important to understand specifically what type of score is being used.

Traditionally, the FICO score is the most popular score used for important loans like home and auto loans. No matter what score you use, most models are looking for a way to predict how likely you are to pay your bills on time.

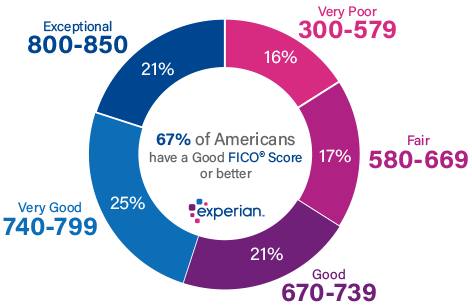

The FICO credit score looks at how much debt you have, how you’ve repaid in the past, and more. Scores range from 300 and 850 and are made up of the following components.

- New credit: 10%. Have you applied for new credit in the recent past?

- Types of credit: 10%. Do you have a healthy mix of different types of debt: auto, home, credit cards, and others?2

Some people don’t have a history of borrowing because they’re young, they’ve never taken out a loan before or had a credit card, or for other reasons. For these types of loan applicants, alternative credit scores look at other sources of information for payment histories, such as utility bills, rent, and more.

The key to scoring well on current debt is making sure most of your available credit is unused. Most experts agree that if 70% or more of your available credit is unused, your credit score should benefit, but if less is available, your score will take a hit. For example, if you have two credit cards that each have $5,000 credit limits, you have $10,000 in available credit. To maintain a healthy credit score, you should make sure that the combined balance you are carrying on those cards does not exceed $3,000. This benefits credit scores because it shows you are able to use credit responsibly without burying yourself in debt.

Payment history and current debt combine to account for nearly two-thirds of your score, so it’s especially important to do well in those areas. The credit bureaus maintain records of late payments for seven years and also keep track of the percentage of payments missed. The age of the late payments also matters. For example, a person who has made 95 percent of her payments might actually be penalized less than someone else who has made 98 percent of his payments on time. This can happen if the first person’s late payments all are five to seven years old while the second person’s late payments all have happened within the last one to two years.

Ideally, you want to make 100% of your payments on time, but if you are late, you want to make sure it is an isolated occurrence so you can put it in the past. The more time passes without any further late payments, the more your score will improve.

Getting Approval

Credit scores alone do not determine whether or not your loan request will be approved. They are simply numbers generated from your credit report and a tool for lenders to use. They set standards for which credit scores are acceptable and make the final decision.

Credit Scores

GOOD: 670-739

VERY GOOD: 740-799

EXCEPTIONAL: 800-850

Source: Experian 2020

Mainland Lenders or Landlords tend to use 30-35% of TENANT’s gross income as the percentage of rent which is the qualifying range for determining TENANT’s ability to pay.

Hawaii RTI tends to be 35-40%+ due to high cost of living. It was reported in 2018 that Hawaii was the 3rd highest cost of living in the U.S.

40x RULE

Many Landlords require that TENANT’s annual gross income be at least 40x the monthly rate of rent.

For example:

$90,000/year = gross income

$90,000/40 = $2,250

TENANT should be qualified to pay up to $2,250/month in rent at $90,000/year annual income.

$2,250 x 12 months = $27,000/year rent paid

$27,000/$90,000 = 30%

Most information from this article is made up of a compilation of excerpts from an article written by Justin Prichard of Balance.com