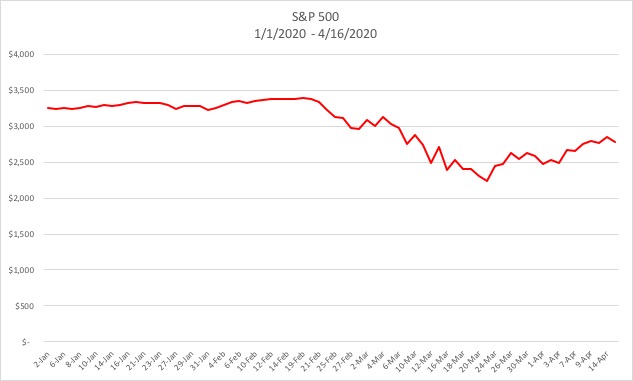

The S&P 500 has lost 13% of it’s value since January 2020, and some investors may be questioning whether or not right now is the time to diversify their holding of assets to include real estate. Having a conversation with your financial advisor would be the first step in deciding how to navigate the volatility in the market. Beyond investing in stocks, bonds and commodities, the following options are ways that real estate might make sense for your overall portfolio. These three scenarios will address questions and considerations to help you make the right choice.

Purchasing Your Primary Residence

When the emergency orders by Mayor Caldwell and Governor Ige asked Hawaii residents to shelter in place, it became apparent that having your own place to “shelter-in” was critically important. As a homeowner, there was a sense of relief when you were able to situate yourself in your own home. Hunkering down while the novel coronavirus is prowling about. Those who are renters might have been equally grateful to have a roof over their heads, but with a tinge of concern about whether or not the economic effects of the shutdown would precipitate a sale of their home. Having a permanent and stable residence is important and it is for this reason that homeownership should be a goal if it is financially feasible.

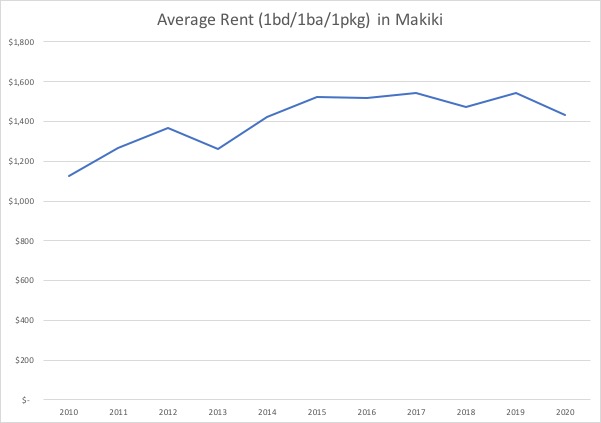

Homeownership allows a person to build wealth and protect themselves from the rising cost of housing. Not to mention it creates a stable environment for the household. If you compare the average cost of renting versus owning over a 10 year period, the differences are clear. The following is an example of owning versus renting a 1-bedroom condominium in Makiki.

| 2010 | 2020 | Wealth Change Per Year | |

|---|---|---|---|

| Rent | $1,126 | $1,431 |

-2.7% |

| Own | $275,000 | $353,000 |

+2.5% |

Tax benefits of owning a primary residence:

- Mortgage interest deduction– Deducting the mortgage interest from your taxable income.

- Homeowner exclusion from capital gains tax- Up to $250,000 of gain for an individual & $500,000 of gain for a married couple.

Purchasing an Investment

When it comes to purchasing investment property there are a few factors to be considered. One would be the horizon of the hold, the second would be your required income distribution and the last would be your desired appreciation.

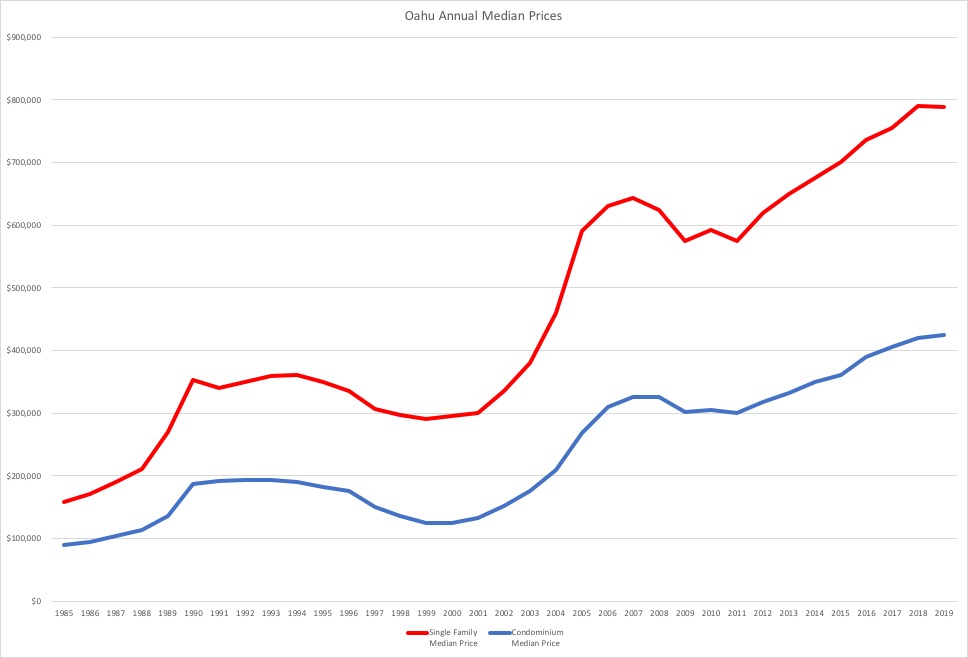

Hold Term

If you are looking to hold your property for less than 5 years then purchasing Oahu real estate right now may not be a good investment. The reason is that the recovery period from an economic downturn may take 2-3 years before the market starts moving upwards again.

Historically speaking, if you plan to hold onto the investment property for 5 or more years, then it becomes a viable investment regardless of the downturn. Positive price-runs in the Oahu real estate market have been from 7 to 10 years.

Income Distribution

The income that you can expect to earn on Oahu real estate is largely a function of your rent minus the overall cost of owning the property. In the following example you’ll see that if you have less cash (down payment) invested in the property, you will have less annual income distributed to you as a property owner.

| 25% Down | 50% Down | 75% Down | All Cash | |

| Purchase Price | $275,000 | |||

| Cash Investment | $68,750 | $137,500 | $206,250 | $275,000 |

| Loan Amount | $206,250 | $137,500 | $68,750 | $0 |

| Interest Rate | 4% | |||

| *Rent | $1,400 | |||

| Principal & Interest | <$984.67> | <$656.45> | <$328.22> | <$0> |

| *Maintenance Fee | <$330> | |||

| *Real Property Tax | <$80> | |||

| **Net Cash Flow | $5.33 | $333.55 | $661.78 | $990 |

| Annual Cash Flow | $63.96 | $4,002.60 | $7,941.36 | $11,880 |

| Cash Flow ROI | 0% | 2.9% | 3.8% | 4.3% |

*These numbers will increase over time largely due to inflation.

**This scenario does not factor in use of a property manager whose fee might be 10% of the gross rent.

Appreciation

Appreciation is when you benefit from an increase in property value. As an investor, you realize the benefit of appreciation when you sell your property, and your cash proceeds are higher than what you initially invested.

| 25% Down | 50% Down | 75% Down | All Cash | |

| Purchase Price | $275,000 | |||

| Cash Investment | $68,750 | $137,500 | $206,250 | $275,000 |

| Loan Amount | $206,250 | $137,500 | $68,750 | $0 |

| Average Appreciation | $7,800 | |||

| Cash Flow ROI | 0% | 2.9% | 3.8% | 4.3% |

| Appreciation ROI | 11.3% | 5.7% | 3.8% | 2.8% |

| Total ROI | 11.3% | 8.6% | 7.6% | 7.1% |

One of the benefits of owning real estate is having the ability to use borrowed money as leverage for your purchase. As you can see from this example, when you borrow more money, you benefit from the appreciation of the borrowed money, which is why the return on your cash investment is higher.

Here are reasons why real estate might be a good investment during an economic downturn:

- Stability of income distribution

- Stability of price appreciation over the long-term

- Tax benefit of depreciation

Rolling Over Your Retirement Into Real Estate

If you have a sizable investment in your retirement account, there may be a way to use those funds to purchase real estate. Aside from being able to have your typical mutual funds, stocks and bonds in your retirement account, you can open up a self-directed IRA in order to purchase other assets like real estate. A self-directed IRA still complies with all the same rules of your retirement account, except that you have a custodian whom you may direct to purchase an asset such as real estate. The following plans are eligible for self-direction:

- Traditional IRA

- Roth IRA

- Simplified Employee Pension (SEP)

- Savings Incentive Match Plan for Employees of Small Employers (SIMPLE)

- 401(K) Plan

- HSA- Health Savings Accounts

If you purchase a property in your self-directed IRA then you can benefit from the appreciation and the rental income tax free, until such time that you take money out of your IRA. When you take money out of your IRA, it is taxed.

What are some of the real estate investment choices that can be purchased in your IRA?

- Single family homes

- Multi-family homes

- Condominiums

- Condotels

- Commercial property

- Vacant land

- Mortgages

- Out-of-state properties

- Leased-fee interest(s)

- Leveraged property

- Foreclosures

Real estate can be a good investment in a market downturn as a way to diversify your portfolio and provide yourself a stable retirement income. If you are renting and haven’t yet purchased a property, this is an opportune time to buy. You’ll realize the investment and tax benefits of ownership, while having the security of your own home.