Overall, the Hawaii real estate market has had a very good run from the days of the Economic Recovery Act of 2008, which implemented that $7,500 first time homebuyer tax credit, to the all time highs of 2018. We have seen more than just a recovery. We have seen one of our longest periods of improvement with respect to housing prices.

Statewide Trend

For the single family market we have seen the number of sales increasing since 2009 but then tapering off in 2018, with fewer sales overall. Being that condominiums are of a more affordable housing category, we didn’t see a decrease in the total number of sales overall in 2018. However, we did see a similar decline in the later half of 2018, which means that the slowdown occurring in the single family market has now moved to the condo market.

Changes On Oahu

Oahu in particular is experiencing a similar staircase-like pattern of growth as we have seen over the past 33 years. There is also a healthy cycle of sales increases and decreases every 7 to 10 years. One key trend that occurs is when a change in the number of sales precedes a change in price. This has happened in every cycle and is also happening at present. The decrease in number of sales in 2018 is a likely signal that we are starting to have a lateral move in prices.

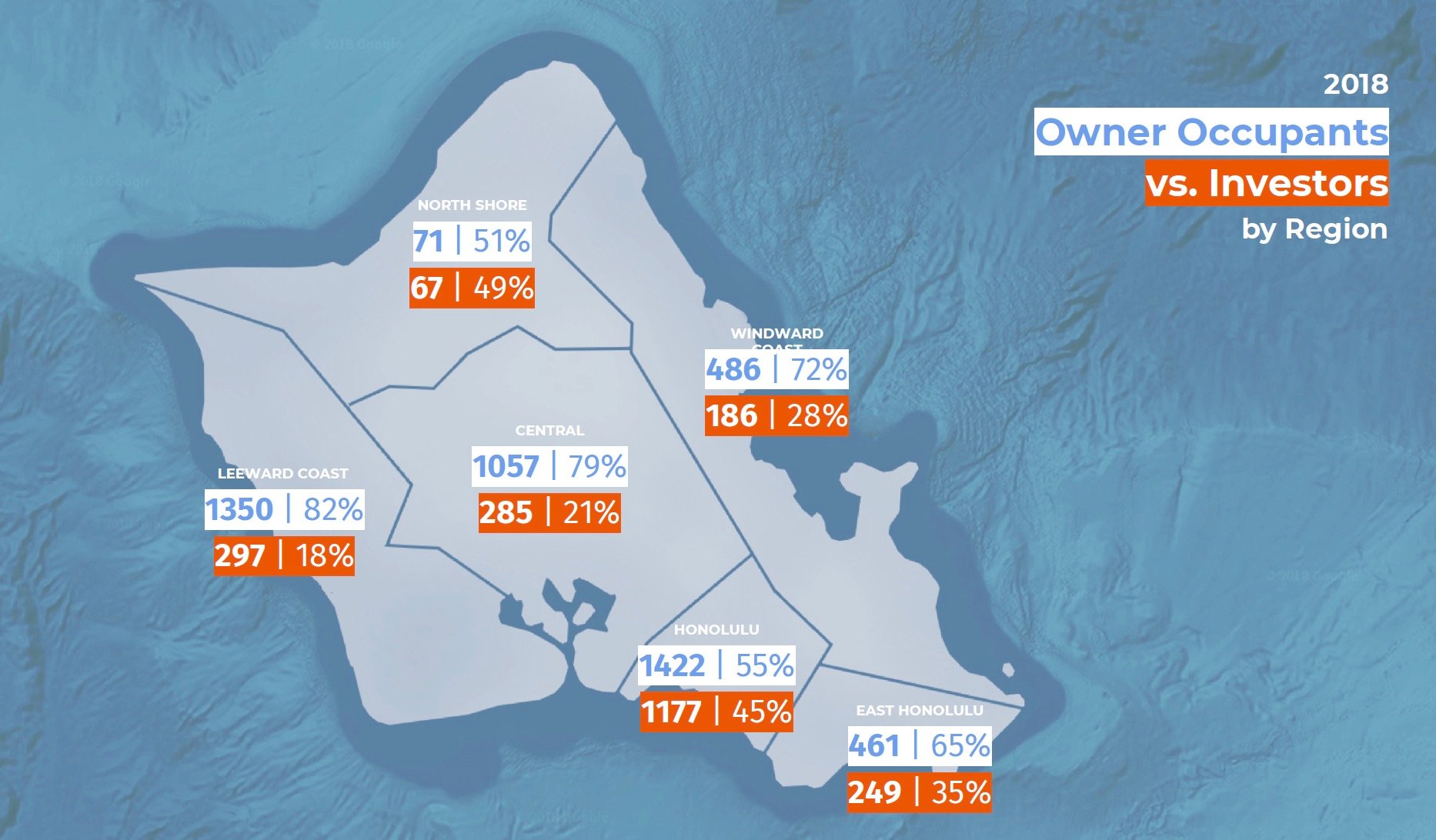

Buyer Demographic

Part of understanding the market is evaluating the demographic landscape of who our buyers are. It is interesting to note that 2018 had witnessed an increase in offshore buyers from areas such Japan, California, Canada, and Korea. On the other hand, there was a decrease in the number of local buyers in the same regions of the island. As usual, Central, West and Windward Oahu, had a strong percentage of owner-occupant buyers, whereas in North Shore, Metro and East Honolulu, there was a higher percentage of investors in the mix.

Luxury Sales

When looking at the most active neighborhoods for single family luxury home sales in 2018, the usual suspects of Kahala, Diamond Head and Kailua Beachside topped the list. Oahu also still dominates the single family luxury market in overall sales. Not surprisingly, Kakaako, Ala Moana and Waikiki are the most prominent neighborhoods for luxury condominium sales. Unlike the rest of the market, luxury properties peaked in sales in 2017 and had a slow 2018. This is not unusual in our cycle, to see the luxury market lead the way of change.

Rental Market

There have also been changes to average rental rates of residential real estate, with some regions of Oahu showing increases in average rents, while others are showing slight decreases. This is to be expected in a changing market. When you have softening sales you typically have a softening of rental rates as well.

Interest Rates

The silver lining to our shifting market is that interest rates have not gone up as quickly as anticipated. In fact, rates are still in the mid 4% range for a 30 year fixed loan. It is anticipated that there may not be much movement for the next several months, but rates could go up to possibly 5% by the end of the year. For higher end homebuyers, it’s good to know that jumbo rates are actually lower than conventional 30 year fixed mortgages.

2019 Forecast

Residential Real Estate in Hawai‘i has seen some leveling off as we depart from the tighter inventory of 2018 to an increase in housing availability in 2019. Sales will perform at a slower pace and number in 2019 than in 2018 with adjustments in price reflecting a more lateral move in the market. If you are a homebuyer you can be more creative with your offers. As a homeseller, you’ll have to work harder at attracting the right buyer, and will have to keep your price attractive.