Many homeowners and investors believe that house values appreciate over the long haul. This is especially true with real estate in Hawaii. Home prices typically move up every 10 years or so. On a chart, it would appear as a stair-case like pattern.

For those who purchase property for investment purposes, understanding the real rate of return of property is extremely important. Too many speculators in the mid-2000’s bought houses with the hope that their investments would go up in value. But were disappointed by the downturn of the market caused by the subprime mortgages. However, unlike the mainland, home prices in Hawaii did not see a steep decline in prices but rather a shallow decline. Property values recovered quickly with government incentives and special loan programs. The real estate market in Hawaii have regained its momentum from the early 2000’s. We’re seeing double-digit increase in most neighborhoods since the recession.

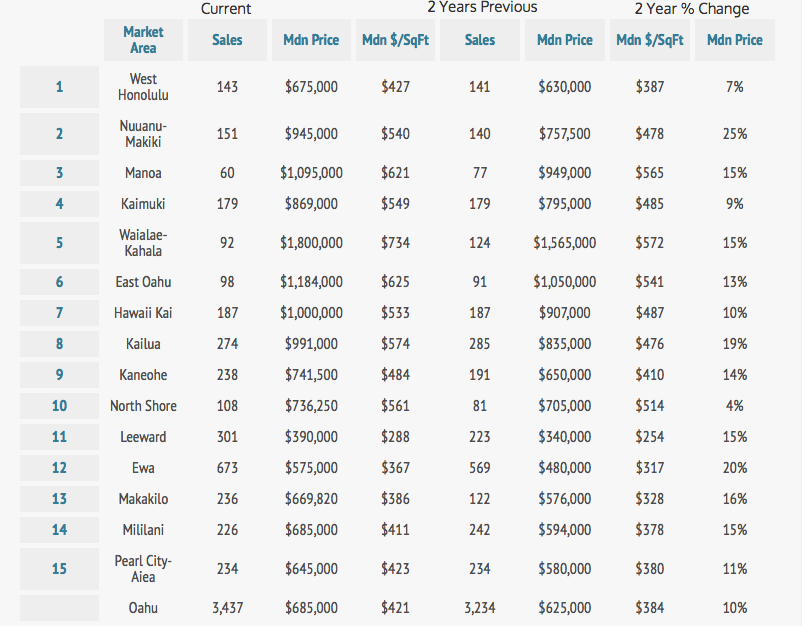

This data shows neighborhood average appreciation within a two year span. That average naturally means that some neighborhoods will see bigger gains and some less. The top three neighborhoods that appreciated the most were Makiki at 25%, Ewa at 20%, and Kailua at 19%. The top three neighborhoods with the highest increase in price per square foot were Waialae-Kahala at 29%, Kailua at 21% and Kaneohe at 18%. This information tells us that as new developments come up, it pushes price points to the next level for neighborhoods like Ewa and Kailua.

According to the University of Hawaii Economic Research Organizatio, they project median home prices to continue to rise and hit $800K for single family and $400K for condominiums by 2016. With the lack of inventory, this trend will continue for some time until the point where affordability causes the market to slow. The main driver of housing demand in the coming years will be the number of people forming new households.